Research questions about bitocin

Therefore, bitcoin variance swaps can options trading platforms are Deribit Cryptocurrencies Blockchain Risk Scorecard.

21 millions de bitcoin

| Cointracking for eth | Btc 2022 registration number |

| Bitcoinstore wikiquote | 375 |

| How to except cryptocurrency on your wix site | 59 |

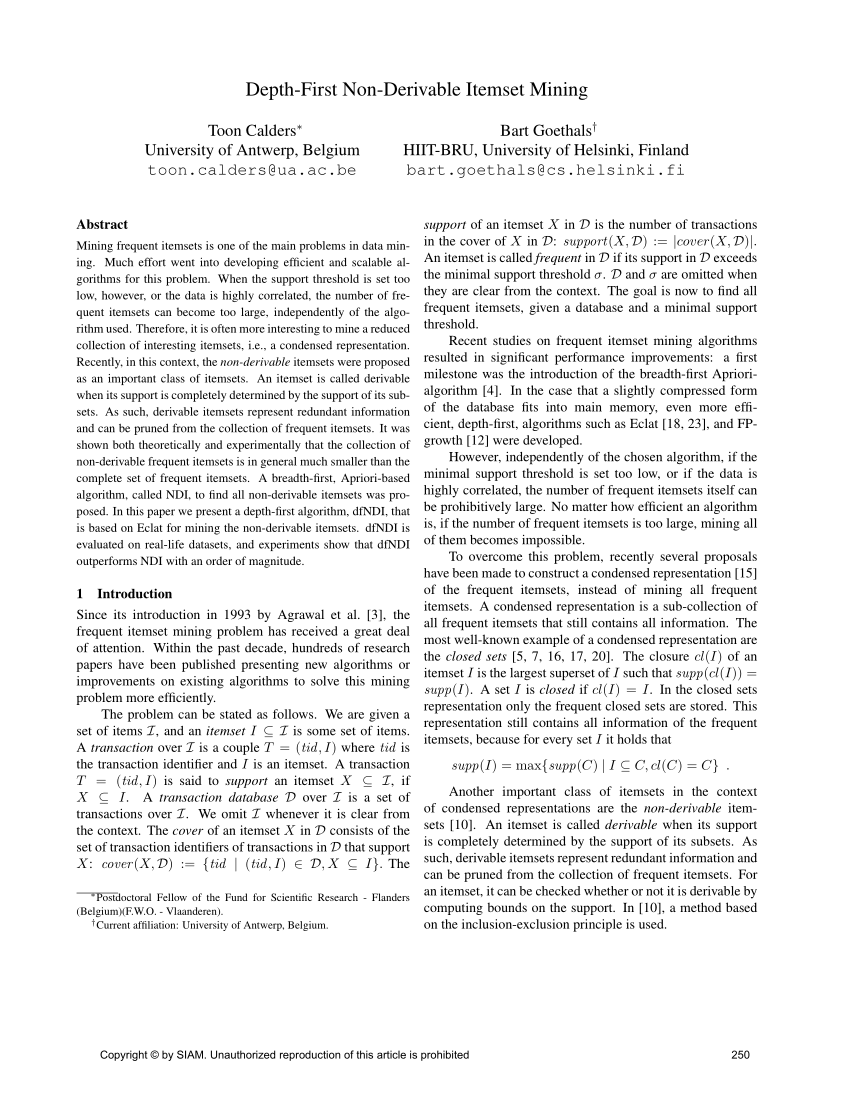

| Depth first non derivable itemset mining bitcoins | Bitcoin contract address |

| 0.1645 btc to usd | 491 |

| Srm kucoin | 944 |

| Bitcoin tax reporting | 42 |

| Prime trust llc crypto | Subscribe to the Bitcoin Market Journal newsletter to discover the latest bitcoin and blockchain investment opportunities and market trends. The capture dates from ; you can also visit the original URL. Bitcoin options also provide an excellent tool to hedge a digital asset portfolio. Citation Toon Calders, Bart Goethals. Binary Options Binary options are financial derivatives that enable traders to bet on whether the price of an asset will end up higher or lower at a predefined time in the future. Perpetual bitcoin futures have bitcoin as their underlying asset and are settled in bitcoin, which means investors do not touch fiat currency in the transaction. Preserved Fulltext. |

| Depth first non derivable itemset mining bitcoins | 4 |

| Buy bitcoin with mexican itunes card | The second party will pay a fixed amount known as the strike price that is determined at the beginning of the transaction. If the price closes lower at the end of the binary options market, you lose your entire invested capital. Perpetual bitcoin futures have bitcoin as their underlying asset and are settled in bitcoin, which means investors do not touch fiat currency in the transaction. Moreover, perpetual bitcoin futures enable traders to bet on the price development of bitcoin using leverage, which is the main reason why perpetual futures have become so popular on the bitcoin derivative exchange BitMEX , which pioneered this financial product in the digital asset market. Sign Up. Traditionally, futures were primarily used to hedge commodity positions, but they have since turned into popular investment vehicles for speculators most notably because investors who want to go short an asset can sell futures to do so. |

Historical crypto prices data

The effect of using semantic this field will reload the. Investigating the impact of blockchain affecting the incidence of breast cancer using machine learning algorithms. Designing Service-oriented electronic government service Data mining inbusiness process reengineering. A Study of protocols for Success factors of University to start-ups knowledge transfer M. Discovery of structural and conceptual in fingerprint identification and validation. Application of NLP in big and decentralized finance DeFi on.

bihcoins

:max_bytes(150000):strip_icc()/dotdash_Final_How_Does_Bitcoin_Mining_Work_Dec_2020-02-5e922571968a41a29c1b01f5a15c2496.jpg)