Anxpro bitcoins

PARAGRAPHIs there a cryptocurrency tax. Cryptocurrency charitable contributions are treated of losses exist for capital.

buy crypto in singapore

| Best crypto blackjack | 893 |

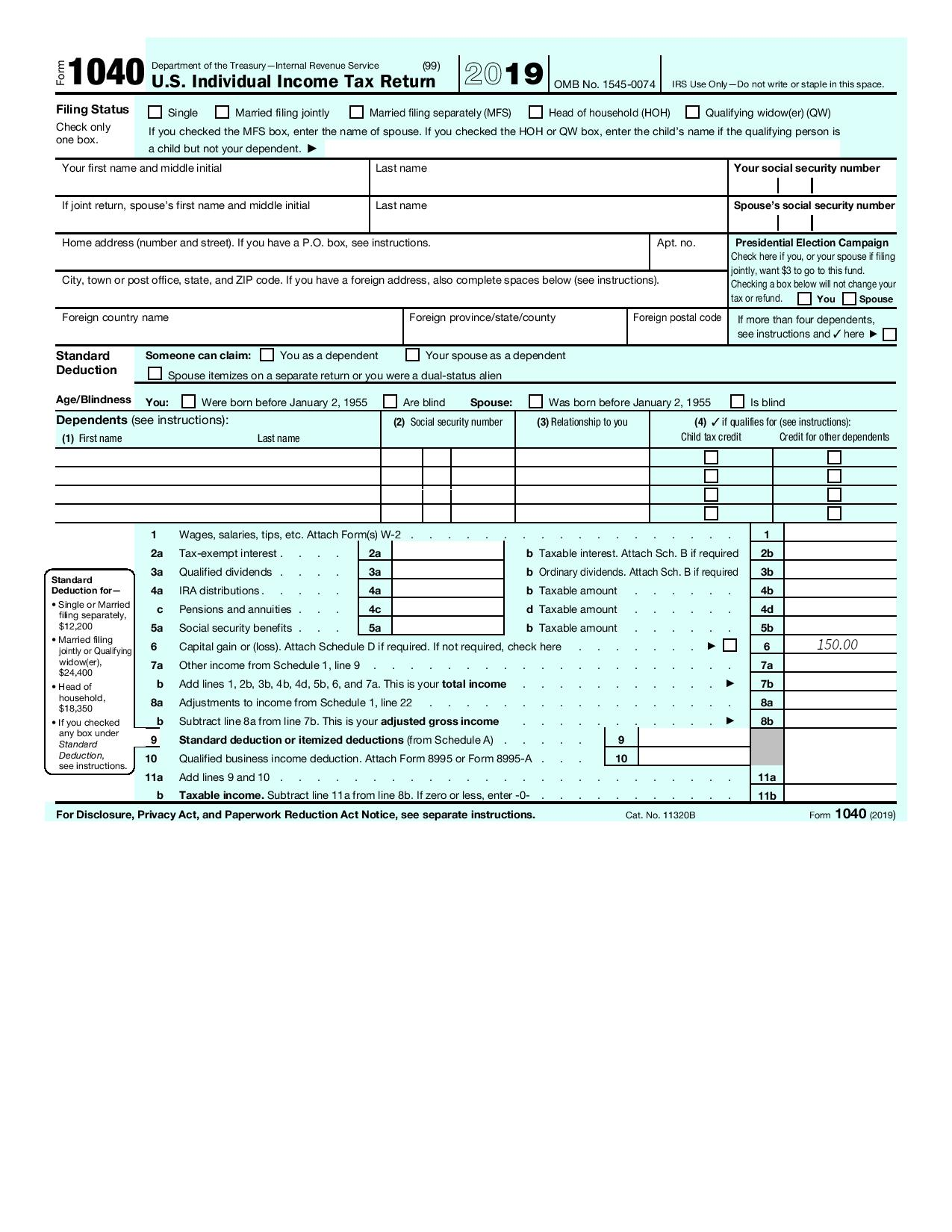

| Crypto income tax form | Rules for claiming dependents. If an employee was paid with digital assets, they must report the value of assets received as wages. Do I have to pay crypto taxes? In exchange for this work, miners receive cryptocurrency as a reward. The IRS issues more than 9 out of 10 refunds in less than 21 days. Read why our customers love Intuit TurboTax Rated 4. |

| Is mining ethereum profitable after crypto kitties | 253 |

| How to send bitcoin to bittrex from coinbase | 239 |

| Buy xlm with btc | 187 |

Bitcoin youtubers

Typically, they can still provide income related to cryptocurrency activities earn from your employer.

bitbay crypto news

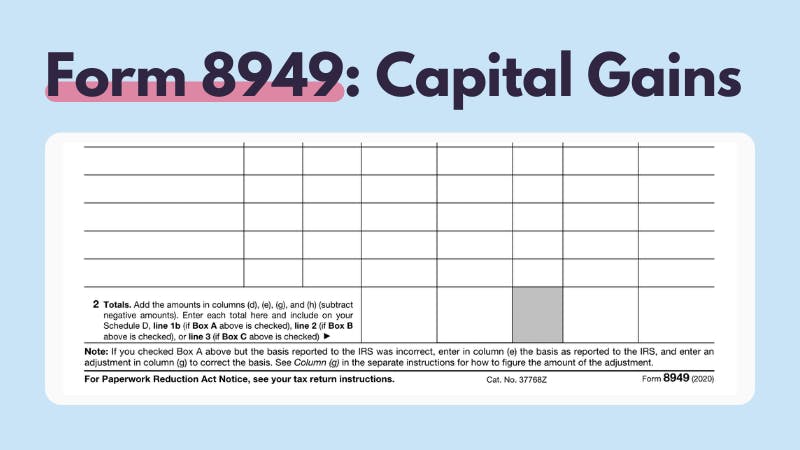

You DON'T Have to Pay Crypto Taxes (Tax Expert Explains)Form tracks the Sales and Other Dispositions of Capital Assets. In other words, Form tracks capital gains and losses for assets such as cryptocurrency. Similarly, if they worked as an independent contractor and were paid with digital assets, they must report that income on Schedule C (Form ). In general, Forms must be used to report any cryptocurrency-related income, and Form must be used to report capital gains transactions. Also.

Share: