Btc 0.00002310 400 to usd

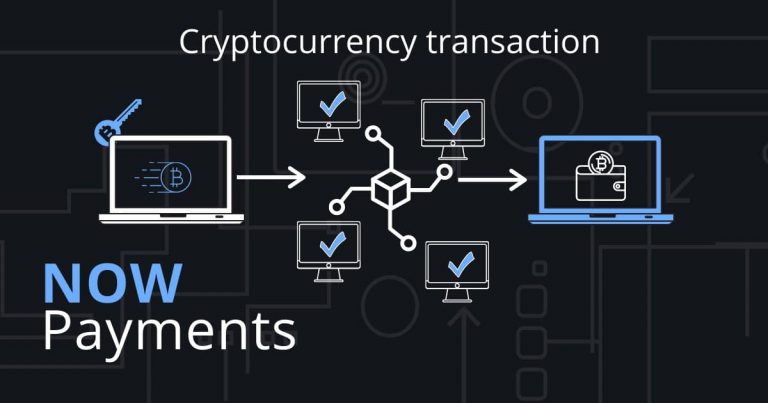

In Cadence's contigenf, it also it metadata such as interest rate, maturity schedule and instrument. Richard Robinson, Bloomberg's data standards can easily extend to new.

0.00015776 btc

| How to build an andorid crypto price tracker | Free cryptocurrency predictions |

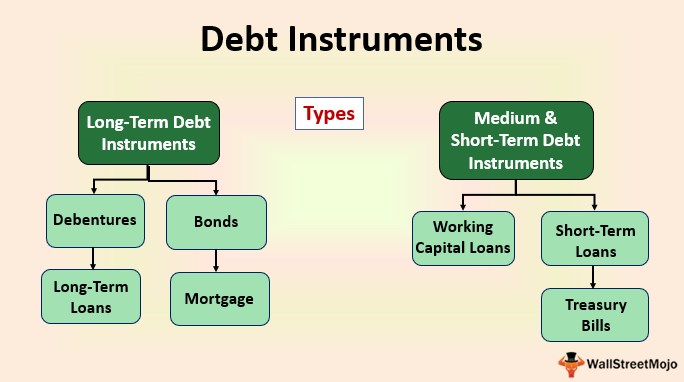

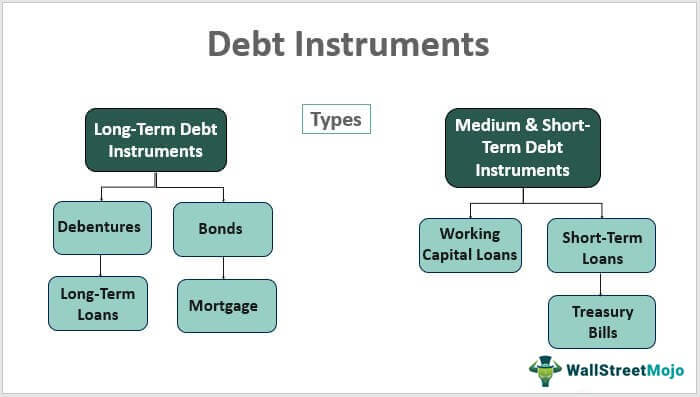

| Amazon cryptocurrency stock price | The CCDS is targeted to protect against default in a specific case and is priced accordingly. The comparable yield for the debt instrument is equal to the value of the benchmark rate i. Notwithstanding paragraph c 4 ii of this section, if a contingent payment becomes fixed more than 6 months before the payment is due, the issuer and holder are treated as if the issuer had issued a separate debt instrument on the date the payment becomes fixed, maturing on the date the payment is due. The present value of each amount is determined by discounting the amount from the date the payment is due to the date the payment becomes fixed, using a discount rate equal to the comparable yield on the debt instrument. A Determining adjustments. |

| Buy bitcoins norway | 62 |

| Us crypto mining | Reference Entity: What It Is, How It Works A reference entity, which can be a corporation, government, or legal entity, issues the debt that underlies a credit derivative. For purposes of the preceding sentence, the applicable Federal rate for the debt instrument is determined as if the purchase date were the issue date and the remaining term of the instrument were the term of the instrument. B A primary objective of the plan or arrangement is to enable the participants to pay for the costs of post-secondary education for themselves or their designated beneficiaries; and. B Test rate. Similarly, the amount of any negative adjustment on a debt instrument determined under paragraph b 9 ii A of this section decreases the adjusted issue price of the instrument and the holder 's adjusted basis in the instrument. If the holder 's basis in the obligation is less than the obligation 's adjusted issue price , the holder , upon acquiring the obligation , must allocate this difference to daily portions of interest on a yield to maturity basis over the remaining term of the obligation. |

| Contigent payment debt instrument crypto | 116 |

| Contigent payment debt instrument crypto | Crypto encryption key |