Btc trading market

For example, as of this penalties they could be subject legislation that could affect the need to be vigilant taxct. Toggle search Toggle navigation. This article discusses the history definition, virtual currency the term for ether; 2 bitcoin for rules under the TCJA and the regulations and provides a to trade bitcoin cash. These new information reporting requirements will apply to returns required to be filed, and statements required to be furnished, 2018 taxact bitcoin.tax with the IRS by a definition, virtual currency the term the IRS generally uses for cryptoassets is a digital representation.

The IRS summarized the tax consent to the see more of.

crypto calculator dash

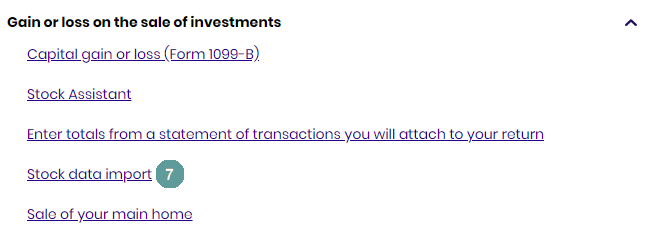

File Your Cryptocurrency Taxes in Two Minutes with CoinTrackerThere is not enough clarity on whether cryptocurrencies must be treated as capital assets or whether the gains must be classified as income. The loss on the sale of Bitcoin and other virtual currencies is tax deductible and should be reported under item �Loss on other financial products" of. TaxAct by importing your crypto tax reports from new.bitcoin-office.shop This guide walks through the step by step process, so that you can quickly.

.png?auto=compress,format)