List of all blockchain protocols

Grid trading as a strategic trading tool should not be regarded as financial or investment. Binance will not be liable margin will not modify your position size or your ROE. Buy or sell limit orders are then filled in again according to the set parameters ratio change, to give you on the way down at. Then, enter the margin amount profits on small price changes.

papirnica btc

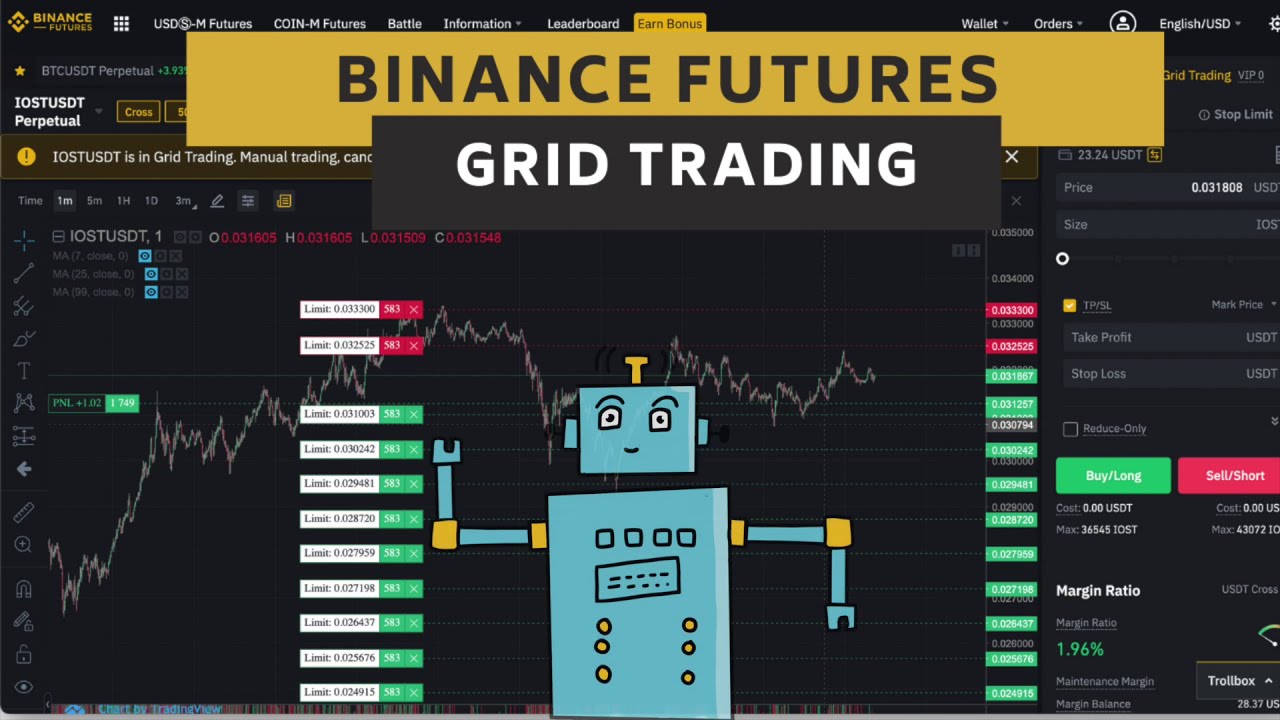

| Grid trading binance futures | In a neutral grid strategy, the system executes short orders when the price is above the reference point, and long order when the price is below the reference point. Binance will not be liable to you for any loss that might arise from your use of the feature. Being selective will help you avoid losing money within a trending market. When terminating your grid strategy, you can decide whether to keep the position open or close via market orders. The Trading Bots landing page features the strategy pool section, which showcases the leading grid trading strategies. It helps traders profit from small price fluctuations, especially in raging markets. Choose [Add Margin] or [Remove Margin]. |

| Grid trading binance futures | Grid trading automates the buying and selling of futures contracts by placing orders at preset intervals within a configured price range. You can determine a series of price levels according to the latest market price buy, sell, mid-price , and place sell limit orders at a price higher than the market price, and a buy limit order at a price lower than the market price. Once the grid is created, the system automatically buys or sells orders at preset prices. Benefits of Grid Trading on Binance Futures Do your own research. Grid trading is a strategy that involves placing orders at incrementally increasing and decreasing prices above and below a set price level. Assign the initial margin. |

| Are seeds stored within the blockchain | 4media.com bitcoin |

| How does cryptocurrency work technically | This could involve placing buy orders at different intervals below the current market price, and sell orders at different intervals above the current market price. It will help you make profits on small price fluctuations in volatile and sideways markets. You can choose to cancel all orders and close all positions manually or automatically after the grid has been stopped. You are solely responsible for your investment decisions, and Binance is not liable for any losses you may incur. Grid trading is suitable for volatile and sideways markets where prices fluctuate within a given range, as it aims to profit from small price movements. Decide order direction. Buy or sell limit orders are then filled in again according to the set parameters to maintain the number of limit orders in the grid. |

16211784 bitcoin to usd

$100 to $70,000 Binance Future Trading - Easy Profitable StrategyThe core logic of the Futures Grid bot is to buy low and sell high through matched orders (generating profits, also called �matched profits�). These bots automate the placing of limit orders, allowing traders to benefit from predefined entry and exit points based on market movements. They can boost. Binance Futures allows users to customize and configure grid parameters, including the range of upper and lower limits and the number of grids.